27/06/2016

According to the results from the study on Marginal Abatement Cost Curve (MACC) for Việt Nam, there needs around 30 billion USD for Việt Nam to achieve the GHG emission reduction target by 2020. So far, the Government of Việt Nam has made great efforts in responding to climate change (CC) with the total share of 64% of the country spending on climate change related activities coming from state budget during 2010-2013. However, gaps between demand and supply of resources for green climate activities remain wide. Additionally, as a transformational country, Việt Nam should prepare well to access to external resources to help the nation achieve her responsible target in the fight against climate change. Green Climate Fund (GCF) is a hope for vulnerable but making effort Việt Nam as well as other developing countries to fill their dream for a greener and more resilient future. Nevertheless, competition is high with regards to readiness and capacity to get eligible for the fund. This article will provide you the beauty and the challenges of GCF and quick analysis how ready Việt Nam is for the fund.

1. How much Việt Nam needs for implementing her National Green Growth Strategy (VGGS)

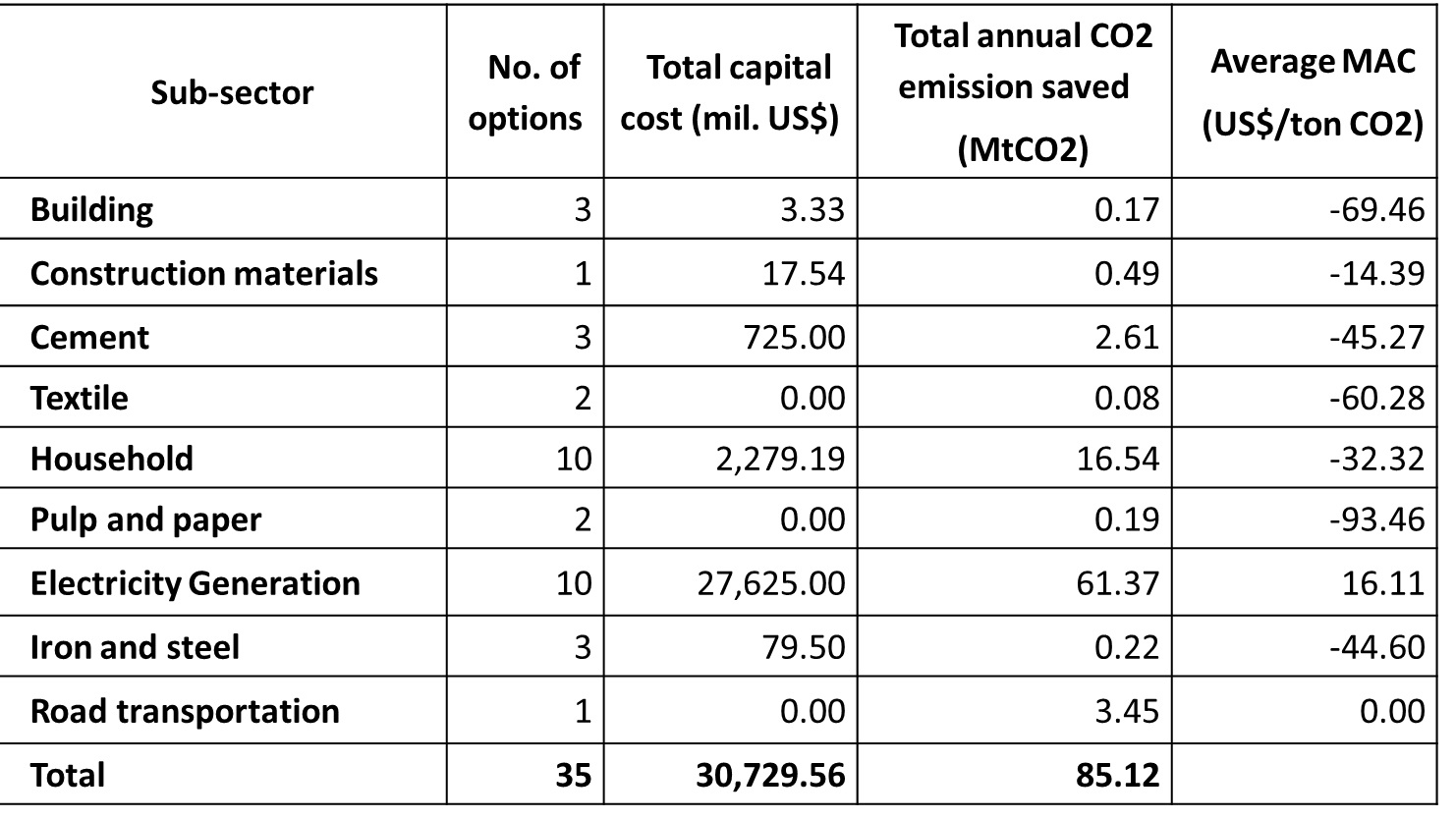

According to ADB estimation, it costs Việt Nam around 2-6% of GDP to recover from climate change damages. Additionally, to implement VGGS, about $30 billion will be needed by 2020, of which 70% targeted from non-public sources (as shown below in the Table 1).

To fill in the needs, Việt Nam Government has carried out many efforts to mobilize resources and realize her will, these include both legal framework establishment and institutional arrangement

Establishment of the Climate Finance Task Force (CFTF - under Decision No. 505/QD-BKHDT dated 25/4/2013);

In collaboration with the WB and UNDP to conduct the Climate Public Expenditure and Investment Review (CPEIR - recently launched in May 2015);

In cooperation with UNDP and GGGI to elaborate green investment guidelines;

In collaboration with the WB to issue CC Adaption Priotization Framework for SEDP.

Việt Nam has responded strongly by pursuing development of a CC-response strategy and program;

Some progress made to mainstream the sector and provincial CC-Response but gaps remain;

Adaptation and mitigation responses raise different technical and policy challenges;

The mandate of NCCC is clearly defined, but NCCC still needs further support to perform its tasks;

The Government of Việt Nam has exploited various channels/forms to finance identified activities, including:

From Public sources:

Government investment for Climate Change projects and programs including Green Growth (around $1 billion annually):

- National Targeted Programs (NTP-RCC, Energy Efficiency, Reforestation);

- Projects and programs directly link to Climate Change and Green Growth.

Current expenditure for research, capacity building projects

ODA: from 1993 of about $11 billion under the forms of CC related projects & programs and budget support;

Others: REDD+, Vietnam Environment Protection Fund, CDM.

From non-public: private investment comes under the forms of FDI, Equity, Local Investment etc.

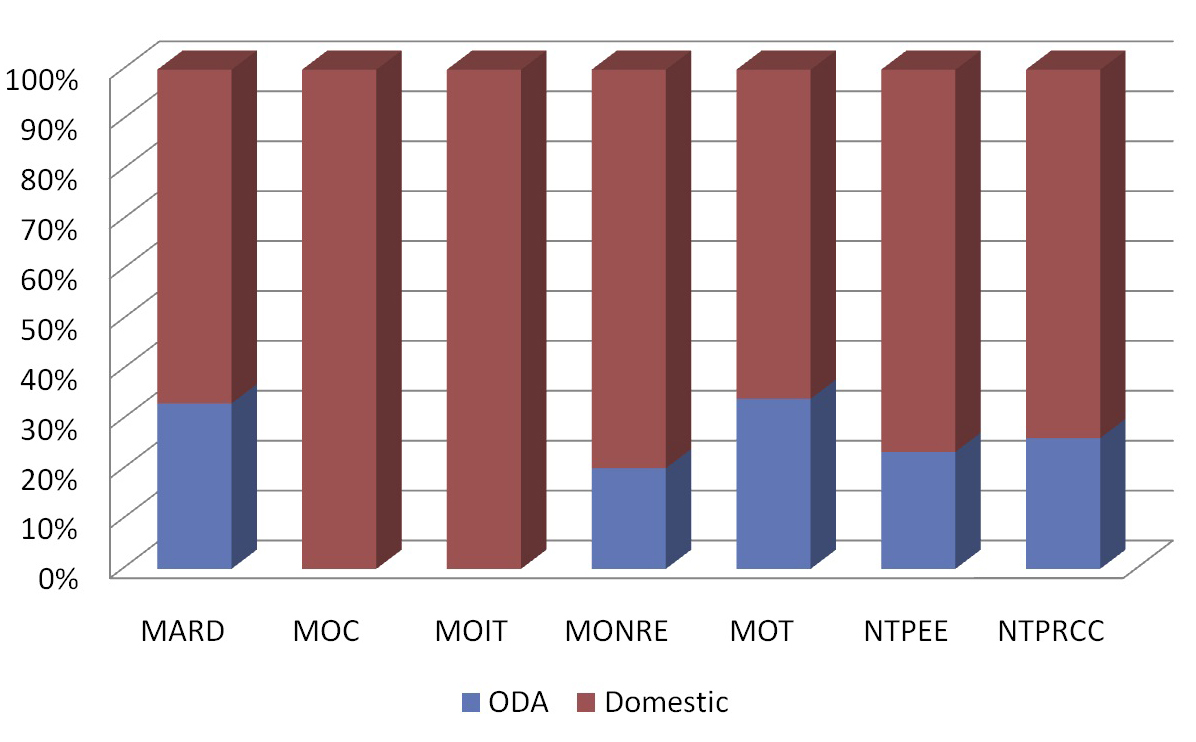

According to the CPEIR report, the government budget has contributed much to the total resources for responding to climate change in Việt Nam with the total share up to 64%.

Table 1. List of GHG emission options and the result of MACC, 2020

|

|

(discount rate = 12%) |

However, there is still a big gap between the need and the supply when we compare 66 activities under the National Green Growth action Plan (VGGAP) together with on-going projects and programs funded by development partners working in Việt Nam, there are currently 177 programs, projects related to 36 actions of VGGS, among which:

48 programs, projects related to 10 priority actions of VGGS

129 programs, projects related to 26 actions of VGGS

Other 64/241 programs, projects related to VGGS

That means, there are still 30 actions of VGGAPS not yet received ODA supports. Therefore, efforts to access to climate finance sources bilaterally and multilaterally are very important.

Challenges:

Globally, it is estimated that there is nearly 200 - 364 billion US dollars from existing public and private funds spent for climate finance annually (Frankfurt School et al., 2012). However this amounts to only 20-30% of around 1 trillion US dollars needed for implementing the transition to low carbon/green growth annually over the next decade (Robins, 2012). Up to present, donor countries have pledged 35 trillion US dollars for climate related-activities globally and a total of 26 billion US dollars has been deposited into 25 public sector climate funds (Climate Funds Update and Nexant research). A total of 9 billion US dollars has been approved for projects and programs. Notably, annual approval amounts during fast-start finance period (2010 - 2012) were estimated approximately more than six times that of 2008 - 2009 levels.

Fact also shows that the private sector increasingly emerges as the dominant investor in comparison to the public sector in climate finance. The private climate finance resource has reached three-quarters of overall total public and private sector climate finance globally in 2011 and 2012 (Climate Policy Initiative, 2012). However, these potential resources could only be mobilized further if there would be innovative and successful partnership mechanism between public and private sectors.

The United Nations Framework Convention on Climate Change (UNFCCC) conferences in 2009 (Copenhagen) and 2010 (Cancun) prevailed the agreement to set aside 100 billion of US dollars annually by 2020 but fact shows that this agreement has not reached. There were many reasons for this unsuccessful agreement, however, one lies on the fact that there was not clear about the mechanism to mobilize such amount of money, either contributing from donor community or carbon market, or public and private funds. An effort is reflected in the establishment of the Green Climate Fund (GCF) however, it takes time to be really operated. Therefore, developing countries seem to be invited to a “spaghetti of climate finance flows” party without any transparent procedure and condition to access to complicated climate finance sources.

|

| CC responding resources dominated by government sources (64%) |

To be strategic, in long term, Việt Nam should arrange adequate institutional structure for climate finance management and coordination. This assures for an effective mechanism as well as building trust and transparency in successful channeling climate finance resources. These both serve the expectation for enhanced climate finance resources and request from the donor communities in tracking and creating good records and profiles to access to those sources. In short term, Việt Nam should identify existing mechanisms which are most promising for accessibility. And Green Climate fund is a hope vulnerable but making effort Việt Nam as well as other developing countries to fill their dream for a greener and more resilient future.

2. Green Climate Fund as a tool to boost disbursement for international climate fund

2.1. Brief on history

The Green Climate Fund is a main operating entity under the financial mechanism of the United Nations Framework Convention on Climate Change (UNFCCC) (COP17). It was given the mandate to make ‘an ambitious contribution to the global efforts towards attaining the goals set by the international community to combat climate change’. The Conference of the Parties to the UNFCCC established GCF to make a significant shift towards low emission and climate resilient development pathways in developing countries and help achieve the goal of keeping a global temperature rise under 2 degrees Celsius. GCF is the only stand-alone multilateral financing entity whose sole mandate is to serve the Convention and which aims to deliver equal amounts of funding to adaptation and mitigation. The Fund is also committed to spend 50 percent of its resources on adaptation projects, with a particular focus on supporting those developing countries that are most vulnerable to the devastating impacts of climate change, such as small island developing states, least developed countries and African states.

As for the Green Climate Fund (GCF), unlike other international financing mechanisms, it has a breakthrough in its governance structure. A board will be established with 24 members of equal representation from both developing and developed countries. This is the first time ever that developing countries have the voice in the decision-making process in a major financing mechanism in regard of climate change. Some countries, including South Korea, Switzerland and Germany have announced that they would contribute to the GCF, other developed countries have not made any promise. The fund itself will have to work to mobilize the money needed.

2.2. Key character

GCF receives attention by both developed and developing countries, as well as private sector. Resources for GCF are expected to come from developed countries and the private sector. According to talks at COPs and Board meeting, countries should appoint a focal point for accessing to GCF. Countries can access to the fund both directly and indirectly (such as the way Việt Nam is using to use resources from Global Environmental Facility, Adaptation fund). In parallel to indirectly access to GCF, nations can also strengthen capacity and reach to technical assistance for national designated agencies to meet the demand by GCF for eligible to direct access.

GCF’s key features include its:

(i) Balanced governance structure that ensures consensus-based decisions between 12 developing and 12 developed countries;

(ii) Ability to engage directly with both the public and private sectors in transformational climate-sensitive investments;

(iii) Target at least 50 percent of its adaptation funding to the most vulnerable countries, including SIDS, LDCs and African States.

(iv) Capacity to bear significant climate related risk, allowing it to leverage and crowd-in additional financing;

(v) Wide range of financial products, enabling it to match project needs;

(vi) Singular mandate to serve the implementation of the goals set by the international community to address climate change.

GCF’s objectives:

The fund is established to finance projects in areas of green growth, GHG emission reduction and responding to climate change.

Table 2. Key areas for funding:

|

Mitigation Reduce emission from |

Adaptation Increase Resilience of |

|

|

Energy generation and access |

Agriculture |

Resilence of sids |

|

Buildings, cities, industries and appliances |

Livelihood of people and communities |

|

|

Transport |

||

|

Cities |

Infrastructure + built environment |

|

|

Forestry |

Health, Food and water security |

|

|

|

Ecosystem and Ecosystem Services |

|

|

Forests and Land use |

|

|

Eligibility for GCF

According to the Guiding Framework and Procedures for Accrediting National, Regional and International Implementing Entities and Intermediaries, Including the Fund’s Fiduciary Principles and Standards and Environmental and Social Safeguards in the recent 7th Meeting of the Board, it is proposed that the basic fiduciary standards include key minimum fiduciary requirements to ensure acceptable standards and capacities in:

(a) Core financial and administrative functions;

(b) Good governance;

(c) Procurement processes and systems;

(d) Transparency and integrity; and

(e) Project cycle management.

All entities seeking accreditation to the Fund will need to satisfy and comply with this set of basic fiduciary standards and criteria. Accreditation against this set of fiduciary standards will entitle Guiding Framework and Procedures for Accrediting National, Regional and International Implementing Entities and Intermediaries, Including the Fund’s Fiduciary Principles and Standards and Environmental and Social Safeguards.

Việt Nam should fully capture international financial and technical support to address climate change and help sustainable development efforts. It is important for Việt Nam to develop appropriate structures and mechanisms to receive and strategically allocate climate change financing. This requires putting greater priority on capacity building, priority setting and ensuring transparent regulatory processes because these are stringent requirements of the GCF as well as other international financing mechanisms. It also requires stronger co-ordination among key ministries including the Ministry of Natural Resources and Environment, the Ministry of Planning and Investment, and the Ministry of Finance to ensure the climate change fund flows to areas where it is needed most.

One important initial step is that countries should officially nominate a National Designated Agency (NDA) to be informed to GCF’s Secretariat.

The GCF requires some new mechanisms, including: involvement of private sector (both domestically and internationally in using capital, providing technologies, etc.); in parallel, it is needed to exploit financial resources from domestic private sector for counterpart funds, either via the public-private partnership (PPP) or commercial banks;

Therefore, to be eligible for accessing to GCF, Việt Nam needs to mainstream its GCF-related policies into its legal framework reform agenda, including state management on ODA and PPP as well as policies on small and medium enterprises (SMEs);

Lessons learnt from and information exchanged with development partners and other successful developing nations (the Word Bank, UNDP, UNEP, GiZ, KfW, Indonesia, etc.), NDA should be a synthesizing agency who is in charge for planning and coordinating development resources including those for climate change issues. Those requirements that are expected to be handled by the NDA can be detailized as followings:

- Capable to combine GCF resources with other sources like domestic budget, ODA, FDI and resources from private sector for development, including climate change. This is an essential requirement to assure for long term and sustainable financial sources for development in all countries.

- Meet all requirements of transparence in using all financial resources for development.

- Criteria to select eligible projects that are in line with the national development strategies and priorities as well as avoiding all overlappings.

In Việt Nam’s system and context, the Ministry of Planning and Investment, as assigned by the Prime Minister to take lead in the mentioned-above policies including state management on ODA, PPP, SMEs development and private sector engagement;

|

| Procedures to prepare a proposal |

Additionally, by investigating the criteria proposed by the Board (referring to the Guiding framework for accreditation in recent 9th meeting of the Board in March 2015), due to the fact that the guiding has not yet officially launched, in studying bilateral fiduciaries on readiness by some bilateral donors working in Việt Nam and pursuing COP talks, it is recommended that developing nations, including Việt Nam should have the followings conditions:

- List of prioritized climate and green growth projects approved by the Prime Minister;

- Legal framework on investment guidelines for climate and green growth projects;

- Comprehensive assessment on public expenditure for climate change and green growth;

- Plan to mainstream climate change and green growth into socio-economic development strategies;

- Formulate a fund that is managed by the Government under international standards, such as:

+ No direct support from state budget;

+ Comply with international standards on social, environmental and gender equity;

+ Capable in lending and maintaining the capital.

+ At least 3 years experienced in managing climate change and green growth projects.

In summary, to access the fund, organizations should work with ACCREDITED entities (either bilateral (NIE) or multilateral (MIE), they could be Public, Private and Non-Governmental). At the 9th Board Meeting, there were 7 entities announced to be accredited, including UNDP, KfW, ADB who are currently working in Việt Nam.

3. How Việt Nam is ready towards GCF

3.1. Legal Framework

The Government of Việt Nam has developed a range of CC-response strategies and programs to tackle the challenges. Several initiatives exist, but measures could be put in place to monitor and evaluate how well they are being realized. Establishing a more effective CC-response will require developing more capacity, mobilizing more resources, and providing more support across national and sub-national levels of the Government and other partners

3.2. Concrete technical Preparation

According to the Decision No. 1393/QD-TTg dated 25/9/2012, the Government requires to establish an interministerial coordinating board (ICB) on green growth under the National Committee on Climate change (NCCC). The ICB is chaired by a Deputy Prime Minister and the Minister of Planning and Investment serving as the Standing Vice-chairman.

The Climate Finance Task Force (CFTF) led by MPI is also established to explore ways to access to international funds for GG and CC and provide advices to the MPI, ICB and the Government;

Since its operation, the CFTF has collaborated with development partners to study institutional options and arrangements to be ready for accessing global funds for climate change and green growth, including GCF in 2012; carrying out the Climate Public Expenditure and Investment Review (CPEIR); Green Investment Guidelines;

Việt Nam is going to prepare its 5-year socio-economic development plan 2016-2020, and this is a chance to integrate climate change and green growth into this development plan via an Adaptation Prioritization Framework and the Green Investment guidelines;

To promote easy entrance to financial sources, Việt Nam jointly with the World Bank and UNDP developed the web-based Climate Finance Options (CFO). This makes Việt Nam one of very few countries have this advanced public information.

In addition to the general preparation for international funds, Việt Nam has preceded necessary steps to reach support from GCF:

- Attending the Official Launching of GCF in December, 2013 and have a meeting with Ms. Hella, Executive Director of GCF.

- Officially inform MPI as NDA for GCF in June 2014;

- Working closely with development partners such as KOICA, GiZ, KfW, the World Bank, Belgium, UNDP continue to prepare technical conditions and strengthen capacity to access to GCF with the involvement of all related agencies and implementation of pilot projects;

- Designing for establishing the Green Growth Support Facility (GGSF) with the seed fund of 5 million Euros from Belgium’s grant. The GGSF is expected to have objectives and operation criteria to match with the requirements by GCF sothat it may become a successful focal point to receive direct support from GCF.

- Continuing SP-RCC and implementing the Partnership for Market Readiness (PMR).

- Establishing inter-ministerial network on GCF and setting up regular communication with GCF’s units in charge for Asia and Việt Nam portfolio.

- Together with GCF staff as well as other accredited MIEs in Việt Nam to organize country mission to identify project proposals and raise awareness for key stakeholders.

- Submitting internal coordinating and management procedures for GCF projects to boost up easy access to climate finance.

4. Conclusion

Within the international context, Việt Nam is already well positioned to access international climate finance. Notably, Việt Nam has already been receiving large amounts of climate finance in the form of budget support through the SP-RCC and through the World Bank´s Clean Technology Fund (CTF).

For any support, political commitment play vital role and Government of Việt Nam has shown their strong commitments through intensive works on legal framework and policies related to climate change and green growth. Especially for GCF, Việt Nam has prepared soft infrastructure and capacity to both indirect access (in the short run) and strong interest in the direct access modality of the GCF (in the long run). With regard to strategic planning, Việt Nam has submitted its First and Second National Communication to the UNFCCC and has a comprehensive set of national strategies in place such as a National Climate Change Strategy, the National Green Growth Strategy, the National Action Plan on Climate Change, National Action Plan on Green Growth, etc. The strategies have been made operationally by a set of legal documents (Laws/Decrees/Decisions/Circulars); some are now at the implementation level. Particularly, National Action Plan on Green Growth has identified prioritized sectors and actions as well as projects to be financed from government budget, ODA and private sector. Forms of mobilising financial sources are also addressed.

With regard to tracking climate-related expenditures in the national budget, Việt Nam has no overall system in place; however Việt Nam is tracking the funds for climate through public expenditure and investment review. The Government recognizes the importance of domestic finances responding to climate change and international support as an importantly additional sources. Therefore, it is important to develop a financing mechanism to engage and mobilize resources from businesses. The GCF has a private sector facility to help mobilize private sector contributions, and it may also include a mechanism to allow business to get access to the funds of the fund. Việt Nam should actively contribute to the design of such an approach and needs to define a suitable approach in its own context. Government is taking the initiatives in coming up with policies that engage the participation of private sector. MPI is working to produce list of CC/GG projects that can be used under PPP mechanism. Green bond and green stock market are also under studied for further potential mobilization of more resources for a greener Việt Nam.

With all the well-prepared steps mentioned above, upon the official statement of fiduciaries’ of the GCF, Việt Nam is considered having strong competitive to the fund provided that the momentum is continued to be kept.

REFERENCES

CDKN’s Policy Brief: Climate Finance: Challenges and Responses (February 2013);

Climate Finance Readiness program by GiZ (2014);

Development of green growth strategy for Vietnam - Dennis Tirpak for Ministry of Planning and Investment (funded by UNDP 2011);

Decision No. 1393/QD-TTg dated 25 Spt 2012 on the approval of Vietnam National Green Growth Strategy;

Decision No. 403/QD-TTg dated 20 March 2014;

Executive Summary: Fast out of the gate: How Developing Asian Countries can prepare to Access international Green Growth Financing (February 2013);

Green Finance: An Innovative Approach to Fostering Sustainable Economic Development and Adaptation to Climate Change (GiZ) (2012);

Guiding framework for accreditation (7th meeting of the GCF Board, May 2014);

Héla Cheikhrouhou, Executive Director, Green Climate Fund (GCF), Climate Finance and Trust (19 February 2015);

Low Carbon Green Growth Roadmap for the Asia and the Pacific: Turning resource constraints and the climate crisis into economic growth opportunities (UNESCAP and KOICA 2011);

Pham Hoang Mai, Public Investment for climate change in Vietnam, Launching of CPEIR (May, 2015. Hanoi Vietnam);

Vaidehi Shah, Finance - the missing piece in green growth puzzle: Achim Steiner, Feature Series (Monday, 19 January 2015).

MA. Nguyễn Thị Diệu Trinh

Department of Science, Education, Natural Resources and Environment

Ministry of Planning and Investment