27/05/2025

Currently, the demand for solid waste treatment is rising as the amount of solid waste continues to grow alongside socio-economic development. On the other hand, the funding sources for solid waste management (SWM) are mainly allocated from the limited State budget, which is a key weakness in this area. Therefore, enhancing participation in SWM plays an important role in contributing to funding mobilization and reducing pressure on the State budget, especially through investments in solid waste management public-private partnership (PPP) projects. The article introduces key findings from the World Bank (WB) research conducted in 2024, which aims to analyze the legal framework, identify challenges, and propose solutions to enhance private sector participation in SWM. This is achieved by promoting investments in PPPs for domestic solid waste (DSW) treatment, contributing to funding mobilization, and reducing pressure on the State budget in this sector.

1. Introduction

Economic growth and rapid urbanization, along with a population boom in Vietnam, have led to an increase in domestic solid waste (DSW) generation. It is estimated that 67,877.34 tons of DSW are generated nationwide per day, with 38,143.05 tons per day produced in urban areas, accounting for 56.19%, and 29,734.30 tons per day generated in rural areas, accounting for 43.81%. Regarding treatment methods, out of the 59,961.68 tons of collected DSW per day, 62.98% is disposed of by land filling, 10.09% is treated using the waste-to-energy method, 14.08% through incineration, and 12.85% is processed into compost from food waste (Pollution Control Department, 2024).

The demand for solid waste treatment is rising as the amount of solid waste continues to grow alongside socio-economic development. The SWM system is currently facing infrastructure challenges, such as a lack of sanitary landfills, the absence of appropriate advanced methods for solid waste treatment, and reliance on State budget allocations for domestic solid waste management (DSWM) expenditures. The funding for this activity comes from the fees for DSWM services charged to households, residents, and the local budget (Gia Chinh, 2023). The World Bank's 2024 research shows that public expenditure on SWM in Viet Nam accounts for 0.23% of the Gross Domestic Product (GDP). Additionally, the State budget allocates 75–80% of recurrent expenditure to collection, transport, and treatment, and 80% of the budget to invest in building DSW facilities. In 2020, the total expenditure on SWM in Vietnam was approximately 610 million USD, including 463.7 million USD from the State budget and 146.3 million USD from fees for domestic solid waste management (DSWM) services charged to residents (WB, 2024).

Enhancing private sector participation in providing DSWM services can offer numerous benefits to enterprises, communities, and the country. The private sector brings economic benefits and innovations to public service delivery in the SWM sector, as it is more motivated to optimize expenditures, invest in advanced technology, and improve management processes. PPP and direct investment are effective ways to mobilize private sector funding for infrastructure development, especially as the Government faces budget constraints.

The 2020 Law on Environmental Protection introduced several regulations on domestic solid waste management (DSWM), including source segregation of domestic solid waste (DSW), fee collection based on waste mass or volume, and Extended Producer Responsibility (EPR). Moreover, the Government has clearly prioritized DSWM in the National Strategy for Integrated SWM to 2025, vision to 2050, as well as in the National Master Plan for 2021-2030 and the National Strategy for Environmental Protection 2021–2030, focusing on DSW reduction, recycling, and recovery.

The article introduces key findings from the WB research conducted in 2024, which aims to analyze the legal framework, identify challenges, and propose solutions to enhance private sector participation in SWM. This is achieved by promoting investments in PPPs for domestic solid waste (DSW) treatment, contributing to funding mobilization, and reducing pressure on the State budget in this sector.

2. Legal framework for private sector participation in solid waste treatment

The LEP 2020, along with the Law on Investment and the Law on PPP Investment (PPP Law), introduced regulations to encourage investments and the implementation of PPP projects in this sector. However, in reality, no PPP projects on solid waste treatment have been implemented across the country to date. The private sector primarily engages through service contracts and participates only in certain stages of the DSWM value chain, such as collection and transportation...

2.1. Policies on selection methods, investment forms, types of contract

The PPP Law came into effect on January 1st, 2021, marking a significant effort by Vietnam to attract PPP projects, with the potential to contribute to the long-term and sustainable outcomes of PPP project implementation (The National Assembly, 2020). Then, in 2021, the Government issued two resolutions to introduce financial management mechanisms and the enforcement the PPP Law, including Decree No. 28/2021/ND-CP, dated March 26, 2021, which provides the financial management mechanism applicable to investment projects in the form of PPP and Decree No. 35/2021/ND-CP dated March 29, 2021 detailing and guiding the implementation of the Law on Investment in the Form of PPP. Moreover, on November 16, 2021, the Ministry of Planning and Investment issued Circular No. 09/2021/TT-BKHDT providing guidelines for selection of investors to implement investment projects in the form of PPP and land-using investment projects.

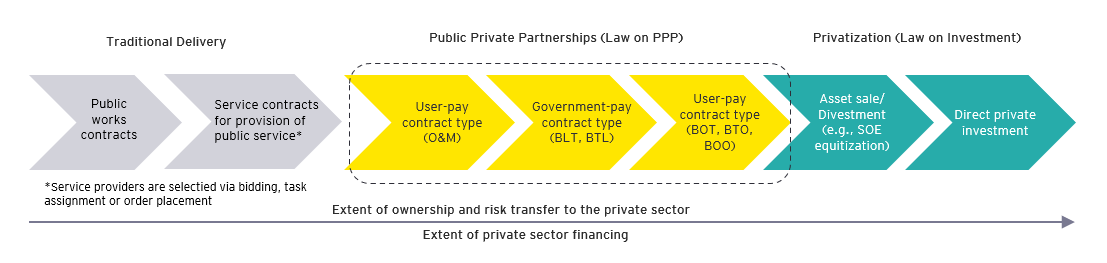

According to the PPP Law and Resolution No. 35/2021/ND-CP of the Government, procurement, ordering, and assignment are the methods for selecting suppliers for public services using the State budget in DSWM. Investments in the form of PPP are applicable to solid waste treatment projects with a total investment of at least 200 billion VND (approximately 8 million USD). Regarding direct private investment methods, the private sector is permitted to collect and transport DSW. Moreover, the private sector is permitted to build recycling factories and develop treatment facilities through two approaches: (i) selection of investors for DSW treatment projects in accordance with the Law on Procurement; and (ii) private investment procedures in accordance with the Law on Investment (Figure 1).

Figure 1. Three main current PSP forms for development of infrastructure and provision of public service

Source: WB, 2024

The LEP 2020 introduces three types of applicable PPP contracts, including: (i) Contracts in which the investor collects fees directly from users (Build-Operate-Transfer (BOT), Build-Transfer-Operate (BTO), and Build-Own-Operate (BOO); (ii) Contracts in which the investor collects fees directly from users (Operate- Manage (O&M)); (iii) Contracts in which the Government pays the investor, such as Build - Lease - Transfer (BLT) and Build - Transfer - Lease (BTL) (Table 1).

Table 1. Types of service contracts in DSWM in Vietnam

|

REF |

Types of service contracts in DSWM |

Current regulations and templates |

|

|---|---|---|---|

|

|

Order Placement Contract for provision of public service using State budget (Collection, segregation, transportation and treatment of waste are in the list of public service using state budget obtained through the ordering or tendering process (Decree 32/2019/ND-CP, Appendix I, Chart 02 – Several classification lists of public service using state budget obtained through the ordering or tendering process) |

|

|

|

|

RFP and bidding contract (in cases where bidders are selected to deliver public services using the State budget) (Type of contract for bidding packages of collection, transportation, treatment of domestic solid waste) |

|

|

|

|

PPP contract |

|

|

|

|

Investment and Business Project Contract |

|

2.2. Institutional framework for implementing of investment projects in the form of PPP in the DSW treatment sector

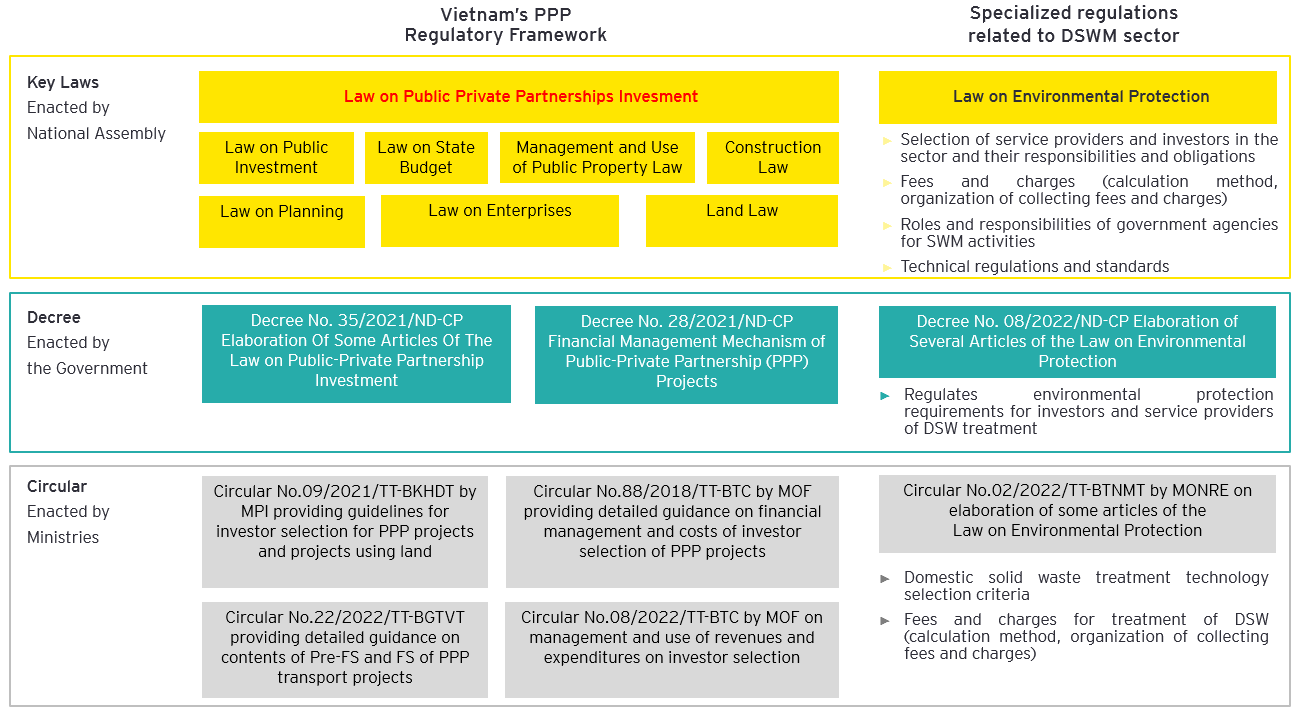

Policies on socialization and the attraction of private investments for SWM have been institutionalized; the legal framework supporting PPP investments in DSWM has been finalized with laws and guiding documents (Figure 2). According to Decree No. 35/2021/ND-CP of the Government and Circular No. 30/2021/CT-TTg dated November 23, 2021 of the Prime Minister on enhancing the enforcement of legal documents regarding investment in the form of PPP and procurement through investor selection, the Government has assigned the Ministry of Agriculture and Rural Development (MAE) (formerly the Ministry of Natural Resources and Environment (MONRE) and the Ministry of Construction to collaborate in developing and issuing a Circular to guide PPP investment projects in the solid waste sector. Currently, the MAE is collaborating with stakeholders to develop a draft Circular for submission, which will serve as the basis for mobilizing private investments in DSWM.

Figure 2. Overview of Vietnam PPP regulatory framework

Source: WB, 2024

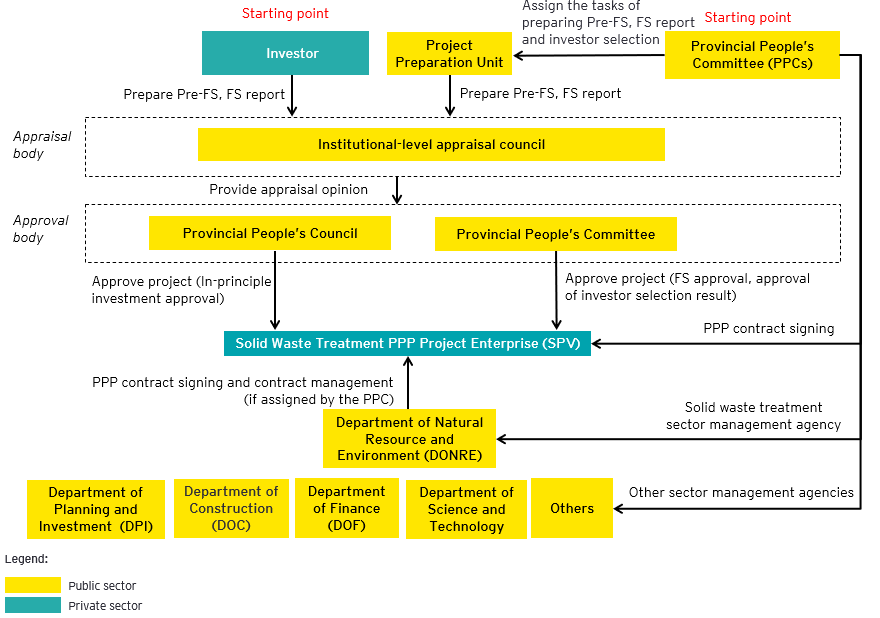

Figure 3. Institutional framework for PPP solid waste treatment projects

Source: WB, 2024

In Vietnam, the implementation of PPP projects is decentralized to local authorities, who are responsible for identifying, preparing, and implementing projects at the provincial level. Based on the rights of DSWM (Article 78, LEP 2020), PPP projects in this sector are typically under the management of provincial people's committees, including DSW treatment projects (Article 3).

3. Challenges and solutions for enhancing PPP investment in DSW treatment

3.1. Key challenges

Challenges relating to access to green finance

In principal, with proper design using clean technology, DSWM projects can be eligible for green/climate finance. However, businesses in Vietnam are generally still at early pathway to unlock green/climate finance solutions.

The current scale of green finance is quite small. By the end of 2022, outstanding loan for green projects only accounts for 4.2% of the total outstanding debt of the economy, at more than VND 500,000 billion (equivalent to USD 20,83 billion). However, most of green financing is allocated to renewable energy sector and green agriculture, which has recorded a share of 47% of 30% of green loan respectively. By contrast, DSWM projects have very poor access to green loan. Among some solid waste treatment project in operation, only Hanoi Thien Y Environmental Energy Joint Stock Company has been granted a green loan of USD 160 million. Other projects such as Thuan Thanh EJS and Everbright Can Tho... have received loans from international and regional institutions.

Similarly, the green bond issuance also faces regulatory challenges. Although the Bond Market Development Roadmap for the 2017-2020 period, with a vision towards 2030 mentioned green bond as a funding for green projects, Viet Nam’s government has neither issued regulation to provide financial policy framework for the development of the green bond market, nor created incentives to attract green bond issuers.

Lack of detailed guidance for PPP projects in solid waste treatment

Decree No. 35/2021/ND-CP (Appendix VI) provides high-level guidance on PPP contract. The Prime Minister assigned MAE (formerly the MONRE) and the Ministry of Construction (MOC) to agree on the focal point to develop and issue a Circular guiding PPP investment project in the fields of solid waste. However, detailed guidance on the PPP contract template in the field of DSW is currently being developed, which will support local authorities in mobilizing PPP investments in the near future.

Limited capacity to develop and implement PPP contracts at the local level

Currently, DSWM activities are strongly decentralized to provincial-level and district-level People’s Committees. Specialized staffs, who often possess technical expertise, find it challenging in preparing investment projects in the form of PPP or to carry out investor selection, especially for BTL/BLT/O&M contracts. Additionally, with the decentralization of PPP project preparation and implementation, the local government agencies, are facing challenges in PPP project structuring, financial appraisal, understanding of overall risk allocation, PPP contract drafting and contract management. The capacity to comply with PPP regulations in accordance with related guidance documents remains limited, particularly in areas such as contract template preparation, work plan appraisal, approval, and implementation.

3.2. Solutions and recommendations to enhance PPP project implementation in DSW treatment

Further development of legal frameworks for PPPs in the DSWM sector

It is recommended that the MAE (formerly MONRE) collaborate with line ministries and local authorities to issue a Circular providing guidance on PPP projects in the DSWM sector. This should include detailed instructions on preparing the pre-feasibility and feasibility studies, a standardized PPP contract template, and criteria for investor selection,... It will be important legal document for the private sector to participate in investments in DSWM in general and DSW treatment in particular in accordance with regulations of Decree No. 35/2021/ND-CP.

Enhancing recycling through the operation of material recovery facilities (MRFs)

Currently, the collection, transportation and recycling of domestic recyclable waste is carried out by the private sector and transferred to the recycling centers (except for composting – which is regarded as a solid waste treatment technology and therefore a public service funded by the Government). Also, the EPR policy requires producers and importers of products and packaging to fulfill their recycling obligations. Thus, it is recommended to develop MRF to facilitate the sorting process and increase the amount of recyclable material diverted from landfills. In particular, it is recommended that the Government Issue a mechanism for the selection of public service providers, along with guidance on technical regulations, technological standards, cost norms, and pricing related to the development and operation of MRFs. At the local level, it is recommended that provincial planning be revised to integrate MRFs into solid waste treatment area planning.

Mobilizing green finance for DSW treatment

Unlocking green/climate finance in this DSW treatment sector will help local private sector tap to wider finance pool, not only limited at local financing sources. It is recommended that the Government issue a green taxonomy and establish a financial policy framework to support the development of green bonds, along with incentives for companies that issue them. Unlocking green/climate finance in domestic market in general and in DSW treatment sector specifically need co-operation and supports among multi ministries (such as MONRE, MPI, Ministry of Finance (MOF), State Bank), development partners and other market builders.

Capacity building for the development and implementation of PPP projects

Decentralization in environmental protection in general and DSWM in particular is a key policy direction of the Party and the State. After the Circular on PPP is issued, it is recommended that the MAE (formerly MONRE) focus on organizing training courses to strengthen the capacity of staff, private enterprises, and local banks in the design and appraisal of PPP projects in the DSWM sector, thereby enabling them to more confidently secure financial agreements.

Nguyễn Trung Thắng, Kim Thị Thúy Ngọc, Nguyễn Thị Ngọc Ánh

Institute of Strategy and Policy on Agriculture and Environment

(Source: The article was published on the Environment Magazine by English No. I/2025)

REFERENCES

1. Pollution Control Department, 2024. Report on the Implementation of Domestic Solid Waste Management Regulations in accordance with the Requirements of the 2020 Law on Environmental Protection (LEP).

2. Gia Chinh, 2023. Vietnam spends too little on handling waste: WB; https://e.vnexpress.net/news/news/environment/vietnam-spends-too-little-on-handling-waste-wb-4593002.html

3. WB, 2024. Study on Vietnam: Private Sector Participation in Solid Waste Management (in collaboration with the Institute of Strategy and Policy on Natural Resources and Environment and Ernst & Young Vietnam) funded by the Public-Private Infrastructure Advisory Facility (PPIAF) and the PROBLUE Multi-Donor Trust Fund.

4. The National Assembly of Vietnam, 2020. Law on PPP Investment (Law No. 64/2020/QH14).

5. The National Assembly of Vietnam, 2020. Law on Environment Protection (Law No. 72/2020/QH14).

6. The Prime Minister, 2021. Directive No. 30/2021/CT-TTg dated November 23, 2021, on strengthening the implementation of legal documents on investment in the form of PPPs and investor selection through procurement.