18/09/2023

A recently published report (10 May) has shown that 2022 was the most active year yet for investments in the circular economy (CE) - an increase of 16 percent. Businesses classified as specifically operating CE models saw an investment of £850 million in disclosed capital across 142 businesses by private investors - up from £788 million across 122 businesses in 2021.

The increase outperformed the whole UK Mergers and Acquisitions (M&A) market where the volume of investments fell by 12 percent. The report, created by Financial Services Company BDO LLP, also shows that venture capital accounted for 62 percent of the transactions last year, supported by mid-market private equity at 17 percent.

Commenting on the findings Rory McPherson, corporate finance partner at BDO, said: “The transition away from linear business models creates value while working towards sustainability goals. As ESG continues to move up the agenda, CE businesses are extremely attractive to investors and BDO is ideally placed to advise the ambitious entrepreneurs and pioneering (private equity) backed businesses in the sector.”

Which CE sectors are seeing the most investment?

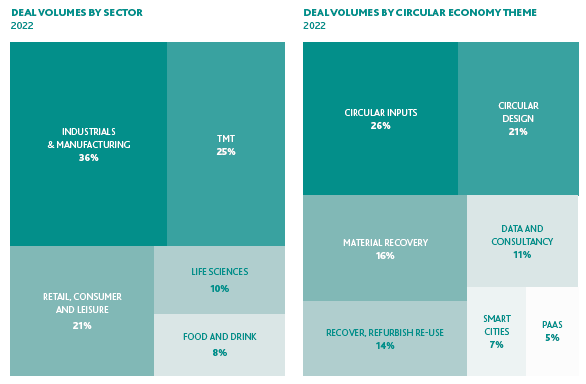

The report found that industrials and manufacturing remain the most prominent sector for investment into the CE, accounting for 36 percent of deal volumes in 2022. This was made up by disclosed investments totalling £180 million at an average of £6.7 million per transaction. Material recovery from waste remains a crucial focus for the sector, with innovative methods being developed by entrepreneurs to extract products or generate energy from waste. In 2022, 35 percent of investments in this area were dedicated to initiatives centred around material recovery.

Incorporating circularity into products, processes, and business models has been a focus for 27 percent of investments, with 22 percent directed towards the use of sustainable circular materials. Both these areas are vital in the industrial and manufacturing sectors' transition towards circularity. The built environment, which represents 40 per cent of deals in these categories, uses nearly half of the globally extracted materials each year, making it a significant contributor to greenhouse gas emissions. Investors have concentrated on businesses that can reduce this carbon impact and substitute legacy virgin materials with sustainable ones. This approach could potentially reduce CO2 emissions from building materials by 38 percent by 2050.

Technology, media and telecommunication (TMT) are the second most prominent area for investors in the CE, accounting for 25 percent of deal volumes in 2022 - with disclosed capital of 173 million at an increase of £67 million since 2021. This is closely followed by the retail, consumer and leisure market at 21 percent and £212 million in disclosed capital - a rise of 46 million since 2021.

What is driving the investment trends in the CE?

Thematically, investments focusing on businesses using or developing circular and sustainable inputs received the most investment last year at 26 percent. The report states that societal desires to consume more sustainable products have led to significant investment in brands using circular, sustainable input materials across all sectors. In the industrial and manufacturing sectors, this can be seen in the prominence of investment into material recovery within the sector at 35 percent.

The trend is also evident in retail, consumer and leisure where 40 per cent of the investments have gone into more circular inputs. This is followed by recovery, refurbishment or re-use (RRR) at 27 percent of investments. The report states that this is driven by the rise in interest in second-hand fashion as consumers are placing increasing importance on businesses facilitating the RRR of products to extend the useful life of assets and slow industry consumption.

Deal volumes by sector and theme 2023

According to investors questioned by the report's authors, environmental, social and governance (ESG) considerations are now essential in potential investments due to their role in both protecting and creating value. With growing demand from stakeholders, such as regulators requiring increased disclosure and consumers supporting businesses that reflect their ethical values, ESG credentials have become a significant factor in assessing consumer-facing businesses. The concept of ESG itself has broadened, now encompassing more than just energy and climate, but also biodiversity and natural resources. The increasing focus on circularity principles in business models aims to reduce costs and enhance efficiency.

According to those questioned, investment decision-making now places ESG at its core, responding to the shift in consumer preferences towards more ethical and sustainable products and heightened regulatory scrutiny. A positive narrative built on this is seen as central to any business's value creation plan. Businesses that drive significant positive environmental and societal change are more likely to yield higher investor returns over typical investment horizons of three to five years.

Example investments

Precision Micro and A-Gas serve as notable examples of businesses investing in the CE. Precision Micro invested £5 million to reconfigure its processes and introduce specialist machinery, which led to a 51 percent reduction in waste ferric chloride production. In 2021, they managed to recycle 97.4 percent of materials, even reusing certain materials in their processes when possible.

A-Gas placed emphasis on Lifecycle Refrigerant Management (LRM) to create a sustainable future for its industry. Through their recovery and reprocessing efforts, they managed to avoid 7.5 million tons of carbon emissions in 2021. In 2022, investments in the CE brought about advancements in various industries, with companies like Pura and Turnkey also cited as examples. Pura, a progressive baby care brand, is making strides in environmental sustainability. It specializes in creating environmentally friendly baby wipes and nappies, a significant move considering that 90 per cent of baby wipes in the UK contain plastic. Turnkey, a technology platform, has focused on providing real-time reporting and detailed insights into company ESG performance.

Recognizing the potential of circular start-ups

The Ellen MacArthur Foundation recently launched its Circular Startup Index to help connect businesses and investors with startups featuring one or more principles of the circular economy. The Index currently contains over 500 companies across the world, with calls from the Foundation for more startups to apply. Commenting at the time of its launch, Ella Hedley, Project Manager, Startups, at the Ellen MacArthur Foundation, said: “Designing a circular future requires radical innovation to rethink how our economy works. Thousands of circular startups are already in the case. But they need more support and investment. So, we created the Circular Startup Index to create visibility of the breadth of circular startups on the market and help businesses discover suitable circular solutions”.

An Vi (Source: Resource)

(Source: The article was published on the Environment Magazine by English No. II/2023)